Unlocking Value: The World of Collectible Wine Investment

Discover how investing in collectible wine can offer financial benefits and personal enjoyment. Ideal for enthusiasts looking to diversify portfolios.

Discover the Unique World of Collectible Wine Investment

Are you ready to explore a niche yet rewarding avenue of alternative financial investments? Look no further than the fascinating world of collectible wine. This growing sector combines passion and profit, offering wine enthusiasts a unique way to invest in their favorite bottles while enjoying the benefits of a thriving market. Let’s dive into how you can turn your love for wine into a smart financial decision.

Why Collectible Wine?

The collectible wine market has seen significant growth over the years, appealing not just to wine lovers, but also savvy investors looking for alternatives to stocks and real estate. Unlike traditional investments, collectible wine is not only a potential source of profit; it’s also an asset you can enjoy while it appreciates in value.

The allure of investing in collectible wine lies in several key factors:

1. Tangible Assets: Wine is a physical product that you can touch, taste, and savor. Unlike stocks, it doesn’t rely solely on market fluctuations.

2. Rarity and Aging: As wine ages, its value can increase significantly, especially if it's from a sought-after vintage. Rarer bottles can be incredibly valuable, providing excellent investment opportunities.

3. Passion Investment: Collecting wine isn’t just about profit; it’s about your love for it. You get to enjoy your collection with friends or even consider it for special occasions.

4. Low Correlation with Other Assets: The collectible wine market often moves independently from stocks and bonds, making it a great diversification tool in your investment portfolio.

Who Should Invest in Collectible Wine?

The target group for wine investments is broader than you might think. While seasoned investors looking for unique opportunities certainly benefit, collectible wine appeals to:

- Wine Enthusiasts: Those with a genuine love for wine are likely to have better instincts for selecting quality bottles that may appreciate in value.

- Cultural Investors: People who appreciate the art and history of winemaking often see investing in wine as a way to celebrate and preserve culture.

- Social Investors: For those who enjoy entertaining or gifting wine, having a collection of high-quality bottles can be both a conversation starter and a gift for friends and family.

Getting Started with Collectible Wine Investment

If you’re interested in jumping into this world of collectible wine investment, here are some tips to help you get started:

1. Educate Yourself: Learn about wine varietals, vintages, regions, and market trends. Online courses, books, and tastings are great resources.

2. Join a Wine Community: Connecting with other collectors or enthusiasts can provide invaluable insights and tips on navigating the market. Consider joining clubs, forums, or social media groups focused on wine investment.

3. Buy with Purpose: Select bottles based on a combination of personal preference and market demand. Look for well-reviewed wines, especially from renowned regions such as Bordeaux, Napa Valley, and Burgundy.

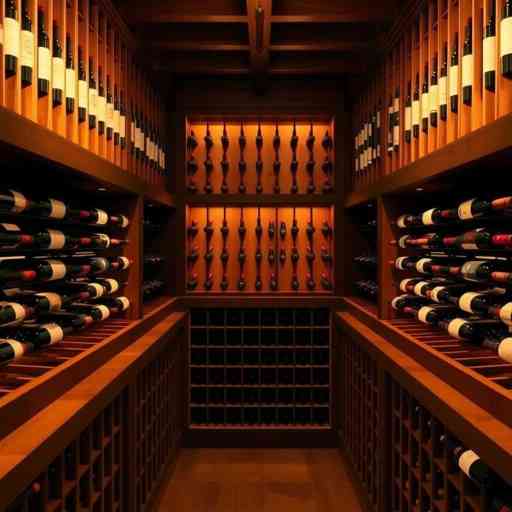

4. Consider Storage: Proper storage is crucial for preserving wine quality and ensuring it ages well. Consider investing in a wine fridge or professional wine storage solutions if you plan on collecting valuable bottles.

5. Document Your Collection: Keep a detailed inventory of your collection, noting purchase prices, tasting notes, and any significant market trends. This information will help track your investment and its value over time.

Investment Returns and Risks

Like any investment, investing in collectible wine carries both potential rewards and risks. Historically, high-quality wines have outperformed traditional investment classes, but there’s no guarantee. Keep in mind:

- Market Trends: Stay updated on wine market trends, auction results, and shifts in consumer preferences. Trends can significantly influence values.

- Market Fluctuations: Prices can be volatile; a sudden surge in demand can spike values, but an oversupply may cause them to dip.

- Liquidity Concerns: Unlike stocks, selling wine can take time and effort. Finding the right buyer can sometimes be challenging, especially for niche bottles.

Conclusion

Investing in collectible wine provides an exciting and potentially profitable way to engage with your passion for this delicious beverage. By diversifying your investment portfolio and indulging your interest in wine, you can savor not just the flavor but also the financial rewards it may bring. Remember to do your homework, engage with other wine lovers, and enjoy the journey of curating your very own collection!

With patience and enthusiasm, collectible wine investment can be a fulfilling adventure, merging both personal enjoyment and the opportunity for growth in your finances.

Exploring Sustainable Art Investing: A Green Financial Niche

Discover sustainable art investing as a unique alternative financial investment that promotes eco-conscious artists while growing your portfolio.

Elevate Your Business with Manchester CRM Experts

Discover the benefits of engaging Manchester CRM experts to enhance your business strategy, customer relationships, and data management. A unique approach to customer success awaits!

Discover the Magic of Art-Based Crowdfunding

Explore art-based crowdfunding as a unique alternative investment. Engage with vibrant artists, support creativity, and enjoy the returns on your investment.